Blog Layout

Turbulence in Financial Markets - Keeping Perspective

Keith Allan • Mar 20, 2020

A few words from our Principal, Jamie Allan

13 March 2020

I want to update you on our thoughts about the impact of Coronavirus on the financial markets and on your personal financial situation.

You will probably not have missed the news that the CoronaVirus has triggered mass selloffs in the financial markets across the globe resulting in dramatic falls in all of the market indexes. This may appear alarming however we see this as a short to medium term economic shock that will pass when the virus effects are over. This will lead to a fall in earnings numbers for a part of this year and inevitably a short recession as growth contracts

I recommend we hold our nerve and maintain our long-term strategy. In consultation with the investors we are working with we view this objectively as a severe market overraction. Markets act in this manner when they are driven by sentiment and act in haste (Apple will be guaranteed to still be selling iPhones at the end of the year, as will Diageo still be selling vodka and Unilever bleach).

The facts are:

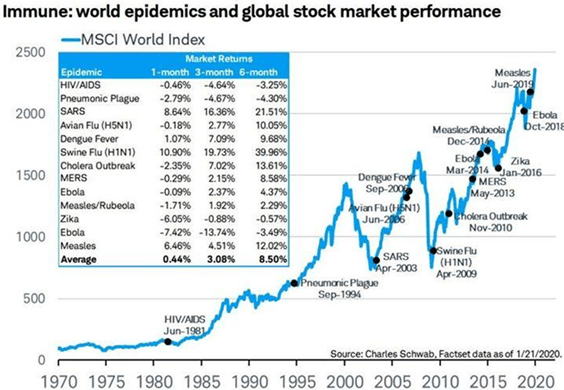

• There have been economic shock events in the past. You can see the dates and details of these events and the market impact in the chart below. You can also see the subsequent recovery.

• Given such shocks happen far more frequently than banking crises and the resilience of the financial system is stronger following the financial crisis of 10 years ago, we see far less stress across the financial system overall.

• Your investments are in a mix of shares and lower risk assets such as bonds, gold, property and low volatility funds so your risks are spread.

• We can find encouragement in the willingness for concerted action between governments (fiscal support) and central banks (monetary intervention) and our chancellor, government and Bank of England are taking the lead amongst the western nations in announcing bold action plans to prevent long lasting economic damage from what increasingly looks like an inevitable but temporary public health crisis.

• Global interest rates are practically now zero and we have a huge international fiscal stimulus promised (widescale govt. spending plans).

• Though we expect turbulence to continue as long as investors can hold their nerve then we would expect a strong global recovery sometime later in the year.

The minimum pension contribution may not be enough. Here are 3 reasons to increase your contributions

JWA Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority.

We are entered in the Financial Services Register Number 798772. (https://register.fca.org.uk)

JWA Financial Planning ltd is registered in England and Wales No. 10093080

Registered Office: The Embassy, 389 Newport Road, Cardiff, CF24 1TP

Should you have cause to complain, and you are not satisfied with our response to your complaint, you may be able to refer it to the Financial Ombudsman Service, which can be contacted as follows:

The Financial Ombudsman Service Exchange Tower, London, E14 9SR. Tel: 0800 023 4567 or 0300 123 9 123 | www.financial-ombudsman.org.uk

The guidance and/or advice contained in this website is subject to UK regulatory regime and is therefore restricted to consumers based in the UK.

© 2024. The content on this website is owned by us and our licensors. Do not copy any content (including images) without our consent.